Navigating Business Risks with Bagley Risk Management

Navigating Business Risks with Bagley Risk Management

Blog Article

The Advantages of Livestock Danger Security (LRP) Insurance Discussed

Livestock Threat Protection (LRP) insurance offers as a crucial device for livestock producers browsing the unpredictable surface of market fluctuations and unforeseen losses. The true worth and details of this insurance tool go far beyond simple protection-- they embody a positive approach that can redefine the landscape for livestock manufacturers.

Financial Protection Versus Market Volatility

LRP insurance supplies manufacturers with a beneficial tool to take care of price risk, using insurance coverage that can aid balance out potential losses resulting from damaging market motions. In essence, LRP insurance offers as a positive risk monitoring technique that equips livestock manufacturers to browse the challenges of a vibrant market landscape with greater self-confidence and safety.

Protection for Unforeseen Losses

Livestock Threat Defense (LRP) insurance policy provides extensive insurance coverage to safeguard animals producers versus unpredicted losses in the unpredictable market landscape. This insurance coverage offers security in instances where unexpected occasions such as disease episodes, natural disasters, or significant market cost fluctuations can result in economic difficulties for livestock producers. By having LRP insurance coverage, producers can minimize the threats connected with these unforeseen situations and make certain a degree of monetary security for their operations.

Among the crucial advantages of LRP insurance is that it permits manufacturers to personalize their protection based on their details demands and take the chance of resistance. This adaptability allows producers to tailor their plans to protect versus the types of losses that are most relevant to their operations. Additionally, LRP insurance coverage uses an uncomplicated cases procedure, assisting producers promptly recuperate from unpredicted losses and resume their operations without considerable disruptions.

Danger Management for Livestock Producers

One trick element of risk administration for livestock manufacturers is diversification. By diversifying their livestock portfolio, producers can spread risk across different types or types, lowering the effect of a prospective loss in any kind of solitary location. Furthermore, keeping in-depth and precise records can help additional hints producers identify patterns, fads, and potential locations of danger within their procedures.

Insurance coverage items like Animals Danger Security (LRP) can also play an essential role in risk management. LRP insurance offers producers with a safeguard against unexpected rate decreases, providing them assurance and monetary protection in times of market instability. On the whole, an extensive risk management method that incorporates insurance policy, record-keeping, and diversity can assist animals producers efficiently navigate the obstacles of the industry.

Tailored Plans to Suit Your Demands

Tailoring insurance coverage to line up with the particular requirements and situations of animals manufacturers is vital in guaranteeing thorough danger monitoring approaches (Bagley Risk Management). Livestock manufacturers encounter a myriad of difficulties one-of-a-kind to their sector, such as changing market value, unforeseeable weather patterns, and animal health and wellness worries. To address these threats effectively, insurance policy providers offer tailored policies that provide to the varied demands of animals producers

One key aspect of tailored livestock insurance coverage is the capacity to personalize insurance coverage limitations based on the size of the procedure and the sorts of livestock being raised. This flexibility makes certain that producers are not over-insured or under-insured, enabling them to shield their possessions sufficiently without paying for unneeded insurance coverage.

Furthermore, customized policies might likewise consist of details stipulations for different sorts of livestock operations, such as milk farms, cattle ranches, or chicken manufacturers. By tailoring coverage to match the one-of-a-kind attributes of each procedure, insurance coverage providers can provide thorough security that resolves the specific risks encountered by various kinds of livestock manufacturers. Inevitably, picking a tailored insurance coverage can supply satisfaction and economic security for animals producers when faced with unexpected challenges.

Government-Subsidized Insurance Options

In taking into consideration danger management methods tailored to the specific demands of livestock producers, it is vital to explore the Government-subsidized insurance options readily available to mitigate special info financial unpredictabilities effectively. Government-subsidized insurance choices play a crucial duty in providing cost effective danger administration tools for animals producers.

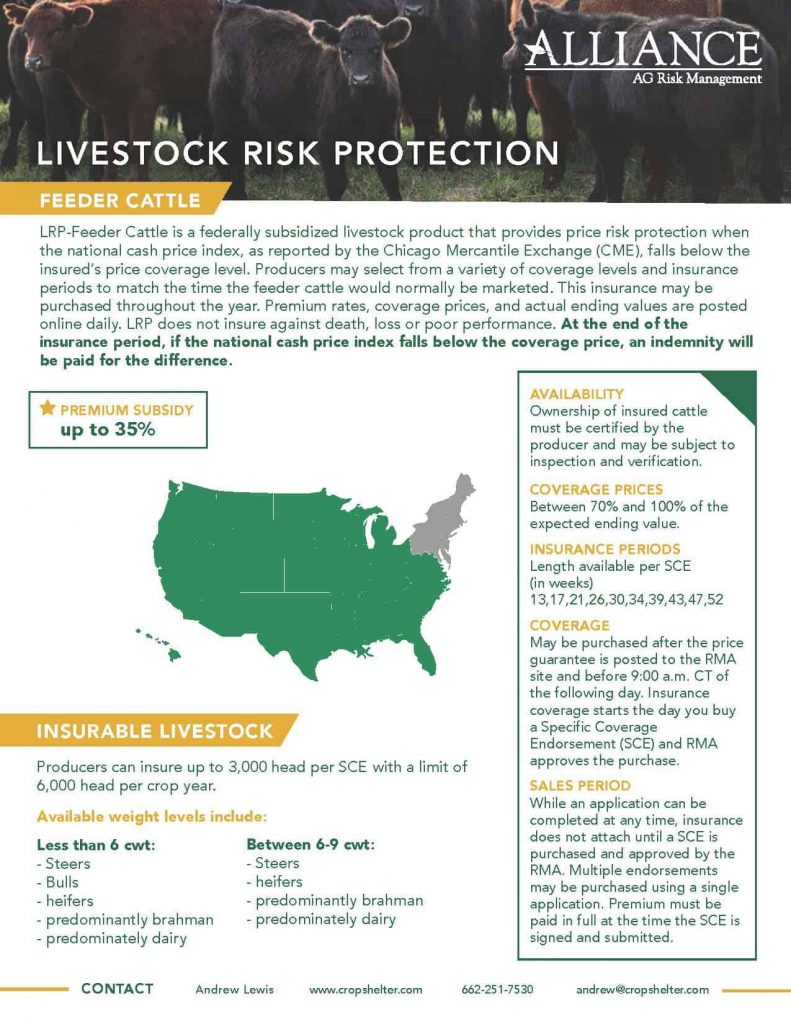

One popular example of a government-subsidized insurance coverage choice is the Livestock Risk Defense (LRP) program, which supplies security against a decline article source in market costs. With LRP, producers can guarantee their animals at a details insurance coverage level, hence guaranteeing a minimal cost for their pets at the end of the insurance policy duration. By leveraging these subsidized insurance choices, livestock producers can boost their economic safety and security, inevitably contributing to the durability of the farming industry in its entirety.

Verdict

In verdict, Livestock Danger Protection (LRP) insurance policy provides financial defense versus market volatility and unexpected losses for animals manufacturers. Government-subsidized insurance policy alternatives further improve the access and price of LRP insurance for producers.

Animals Threat Protection (LRP) insurance policy offers as a critical tool for animals manufacturers navigating the uncertain surface of market changes and unexpected losses.In today's unforeseeable market setting, animals producers can profit considerably from securing monetary defense versus market volatility with Animals Threat Defense (LRP) insurance coverage. In essence, LRP insurance policy serves as a positive threat management method that empowers livestock manufacturers to browse the obstacles of a vibrant market landscape with higher self-confidence and protection.

Livestock Risk Security (LRP) insurance coverage uses thorough protection to secure animals producers against unanticipated losses in the unpredictable market landscape.In conclusion, Livestock Threat Protection (LRP) insurance coverage provides financial protection versus market volatility and unpredicted losses for animals producers.

Report this page